On your marks, get set, go!

Designed to help you achieve more

Free banking on everyday transactions for the first 2 years

Free accounting software from FreeAgent

Free support to help you grow

The Start-up business account is available for businesses that have been trading for less than 1 year and have a turnover of less than £1m. It is available for eligible customers who are over 18 and have the right to be self-employed in the UK. FreeAgent is free for as long as you retain your bank account. Optional add-ons may be chargeable.

Free banking means the charges for the day to day running of your account (known as your service charges) won’t apply during the free banking period. At the end of this period, you’ll be automatically moved to the Standard Tariff. Charges for unarranged overdrafts, Bankline, international payments and any additional services are not part of the free banking offer. The 2-year free banking offer is available to eligible customers opening a Start-up account from 26th June 2023 onward.

What you pay for - and what you don't

For details of our full charges and to see a breakdown of what’s included within the above transaction types, please refer to ‘Info about charges’ section in the bottom of this page. This is based on our current pricing. Please note that our charges may vary from time to time and you will be notified of any changes to our charges prior to these taking effect.

We’re here to help you thrive

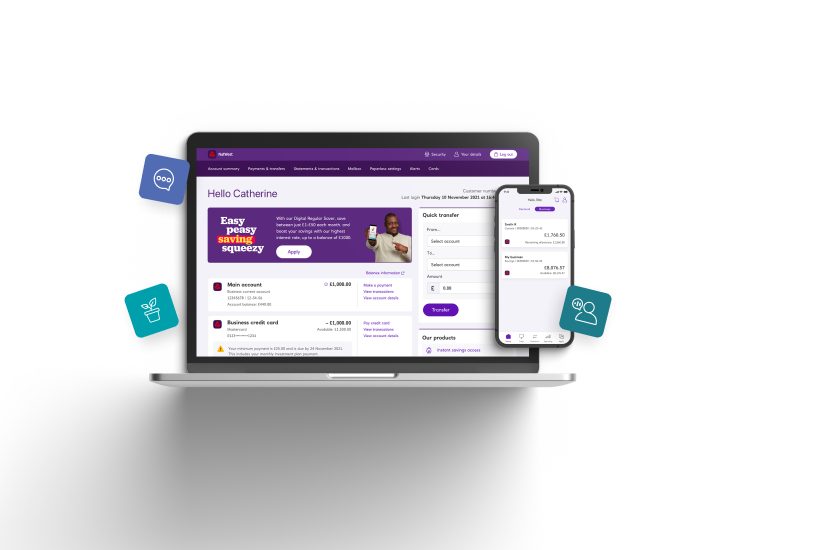

- Bank anywhere with Online Banking, our mobile app, or at our network of branches or local Post Office

- 24/7 messaging support, plus the option to give us a call or stop by your local branch

- Instant payment notifications, in-app cheque deposit (limits and fees may apply), and business spending categories to help manage your money

- Multi-director access so eligible directors can have full visibility of accounts and spending

App available to customers with compatible iOS and Android devices and a UK or international mobile number in specific countries.

Loans and finance options

Explore options based on your size, your needs, and your goals.

Security may be required. Product fees may apply. Subject to Status.

Business credit card

No annual fee for the first year (normally £30). Plus, you can manage your account with the ClearSpend app.*

The flexibility of an overdraft

Our business overdraft helps you prepare for the unexpected. You’ll only pay interest on what you borrow.

Security may be required. Product fees may apply. Subject to Status.

Business savings accounts

Make your money work as hard as you do with a Business Savings account. As an example, our Liquidity Manager 95-day Notice Account has an interest rate of 4.25% AER, 4.17% Gross p.a. (variable).

Note: The Liquidity Manager 95 interest rate will decrease to 3.75% AER / 3.69% Gross p.a on 15th July 2024.

Eligibility criteria apply. Interest rates are subject to variation. Early withdrawals from the Liquidity Manager Notice Accounts are not permitted.

*To apply for a NatWest Business credit card, you must be a UK resident aged 18 or over and maintain a business bank account in the same legal entity name with NatWest. Your registered business must be in the UK and you should be registered for tax purposes in the UK. The NatWest Business credit card is subject to status and for business use only. Applications for our Business credit card are subject to approval. If you apply for any other credit facilities, security may be required and product fees may apply.

Switch to us

Current Account Switch Guarantee (PDF, 40KB)

Your Guide to switching your account to us (PDF, 2.3MB)

Info about charges

At the end of your 2-year free banking period, you’ll move on to our Standard Tariff, with no minimum monthly charge.

Business Account Charges Booklet (PDF, 80KB)

You're safe with us

We’re a major high street bank and deposits of up to £85k are backed by the FSCS.